The Problem/OPPORTUNITY

In 2018, Mexico had 16.4 million households (approximately 60 million people) with no access to the Internet. Wired and mobile broadband penetration in Mexico is below the OECD average, with over half of the population with no connection.

In recent years, Mexico has also passed pro-competition regulation that deeply affected the entire Telecom industry, going from an almost monopolized industry (traditional players), to a shared market (new MVNOs). This systemic change means moving from a situation of high concentration, high prices, lack of service quality, to an ideal environment for competition and sustainable development.

Project Goals

Among the key objectives of the new regulatory framework, access to the internet was critical for the success of the initiative. With this favorable environment and the correct mix of technical expertise, we launched RedConcero, a new venture aiming to bring connectivity and financial inclusion to underserved communities in both rural and urban areas.

We bring broadband communication and financial inclusion to the underserved people of Mexico and Latin America for the purpose of empowering them economically and as citizens

RedConcero Mission

By offering a suite of services/products through a trusted networks of local partners, we could improve the quality of life of millions. Our main inspiration for the product vision was the success story of M-Pesa, a mobile-based money transfer service, payments and micro-financing service, launched in Kenya over a decade ago. However, we had to re-design the whole business model to adapt it to the Mexican context. Research was necessary.

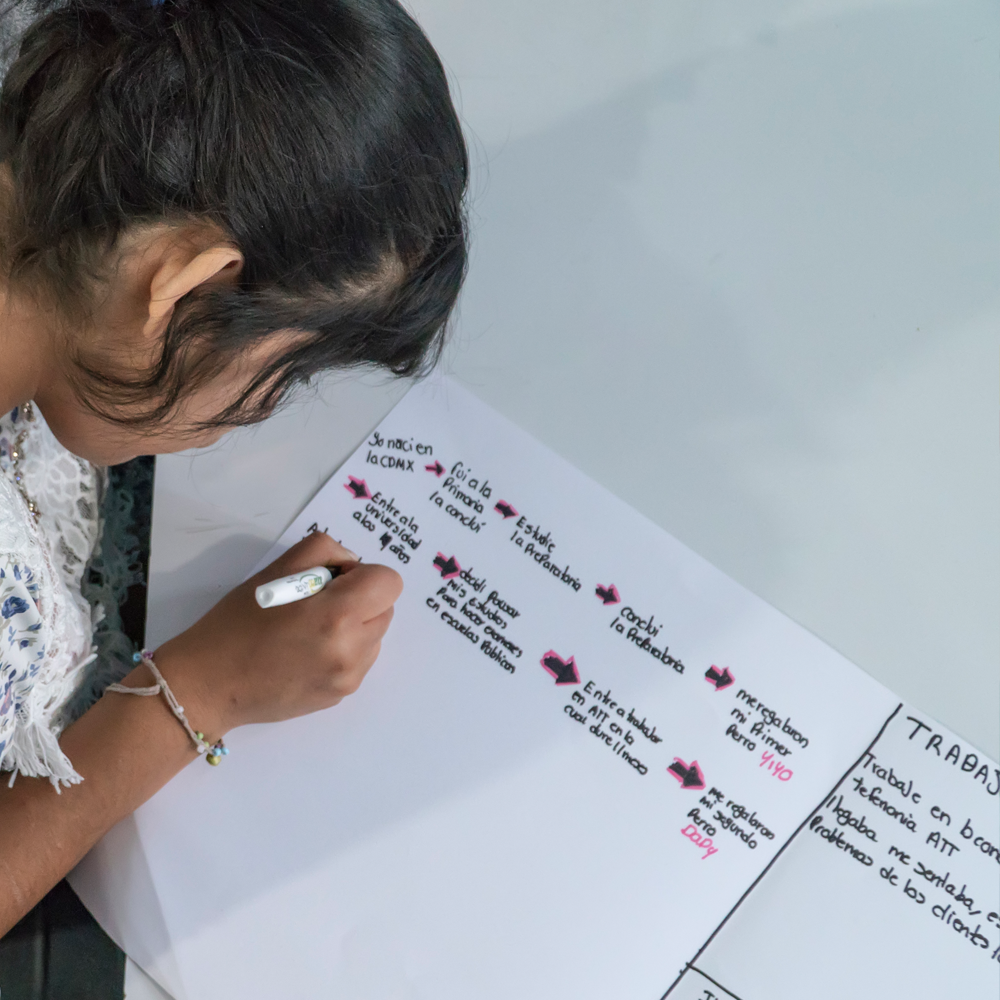

The most impactful methodology we used to validate our key assumptions was design thinking. We asked our ultimate beneficiaries what needs were relevant to them, without pushing any prepackaged solution. This approach helped us build trust with local leaders of the communities we were targeting.

PRODUCT STRATEGY

The Internet brings infinite opportunities that can change lives: so many opportunities that might be overwhelming to start. Sitting in front of a search engine page can be intimidating, especially if your priorities are the financial sustainability of your household. For this reason we decided to develop the product roadmap based on two main objectives:

- Offer affordable, prepaid, high-speed internet access, both for households and mobile

- Open a mobile wallet linked to low-risk bank account to provide basic financial inclusion

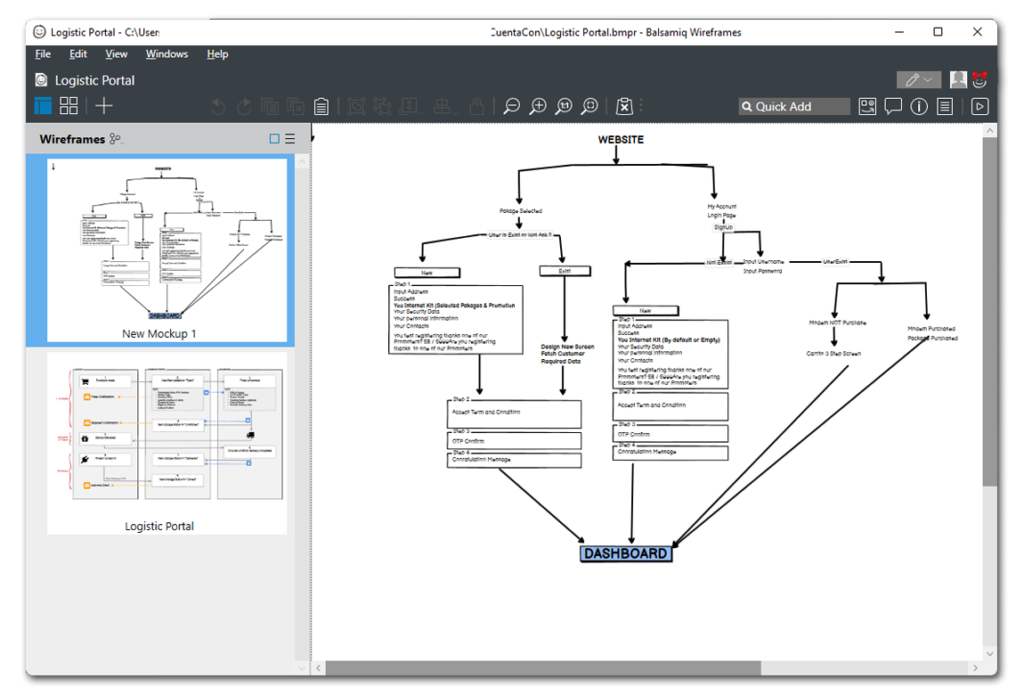

After mapping the infrastructure integration needed to connect to the 700Mhz broadband, and closing contracts with key partners, we focused on designing a User Experience that would be at the same time familiar and easy to use.

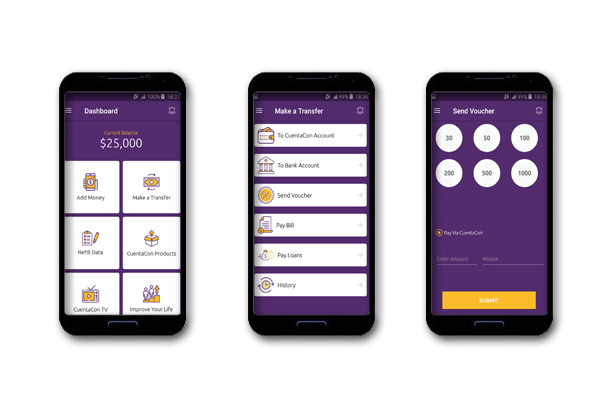

Workflows & Wireframes

We identified activities and habits that could help us spot the best way to approach the idea of a digital bank account directly connected to your phone. For this reason we had to work different sketches that brought us to prioritize on the top-up experience that they were used to with their phones.

mobile USER experience (UX)

Most of our target users were used to make top-up to their prepaid phones. Another common trait was the total lack of experience with any mobile banking solution.